Again, I will start the article with the purpose. And the purpose here is slightly different from the article on Consulting Case Preps. Yes, this too serve the purpose of a wider reach and archival. However, the primary reason for this post is discontent - and not the two above. Discontent because the ISB Co2010 casebook only includes the cases that were given to me by the company whose offer I finally accepted. However, I had painstakingly written the records for all the interviews that I appeared in, which obviously never saw light of the day. Hence, in an attempt to save the efforts, I have decided to put these up on my blog as well. Of course, these will serve as an appropriate compliment to the article on Case Preps.

To avoid any sort of controversy, I have disguised the name of the companies and the firms in this article.

Company: XYC, Interview No. 1

Interviewer: N, Principal

Personal Interview Questions

The interview started with a case, unlike most of the other interviews that I had given. In fact, most of the interviews at XYC started with a case and then the PI. However, since this section is mentioned before the case, I will list down the PI questions here.

1. Tell me about yourself – standard question, was well prepared for this

2. Most significant achievement – talked about IQRS Level 8 that I implemented at ITC, and that it was the first time any company had achieved that in India. He enquired more about the same, including the complexity of the task and my learnings from the task.

3. Why Consulting and why XYC? – had a well prepared answer. Since my first choice was XYC, had a tailor-made answer for why XYC, and he was visibly impressed.

4. Any question for him – had read his bio-card, so asked him a question in his field of work.

While I left the room, he told me he liked the passion with which I spoke about my work experience. He asked me to continue the same in the remaining interviews. There’s a small background to this, which is not appropriate to mention in this space.

Case Question

1. Why is the stock market performance of this particular company poor in the last 2 years? (it was underperforming the market by 15%)

2. How to turnaround?

Case Type

Case on stock market performance

Narration of the Case

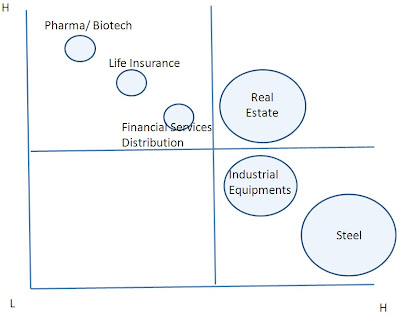

He drew a XYC matrix for the portfolio of companies this company owned. He told me that the stock was underperforming the market by 15%, and I had to identify why and what to do for a turnaround. Here’s how the XYC matrix looked:

I told N that stock market performance is generally affected by the company’s performance against Analyst forecasts. Hence I asked him how the company was performing viz. a viz. analyst forecasts. N told me that it was a good thought, but for the time being let us assume that the analysts do not cover this company. He told me that he knew it was an unrealistic assumption, but he wanted me to continue with this assumption.

Next I asked him how the company was performing w.r.t. to its competitors in the various segments. I got the following data:

Steel and Industrial Equipments – in business for 2 decades, EBITDA slightly better than competition

Real Estate – in business for 10 years, EBITDA slightly lower than competition

Other 3 businesses – 5 years old, EBITDA lower as they were new, but they were meeting their EBITDA targets as per initial business plan.

Then I proposed a hypothesis to N, which was based on the MM principle (Corp. Fin.). I told him if the investors can do what the company is doing, then investors are likely to value the firm lower and hence stock performance may suffer. I told him I wanted to test this hypothesis in this particular case. N told me to build upon the idea. To understand about the investors a bit more, I asked him about the type of investors the company had. He asked me what the typical types of investors are. To this I listed 2 types of investors:

1. Investors looking for Dividends

2. Investors looking for Capital Gains

N told me there is another type, which I could not come up with – Speculative Investors. Then he asked me to identify for which of these investors the portfolio of businesses was better suited. I told him that it was suited for neither. The logic I gave was that the dividend type investors would not want any diversification into new businesses like FS, Insurance, Pharma or Real Estate. The capital gain investors would be interested in these new sectors, but given the relative size of these businesses, any good performance in these sectors would be absorbed by the two large sectors of Steel and Industrial Equipments. N seemed to be happy with the answer.

N now asked me what the company should do. I told him that the company can look into listing these companies separately so that they cater to the needs of the particular type of investors. He asked me given the company the company has 6 different businesses as of now, how many companies should be listed and how many of them should be kept together. I made a small structure to evaluate the same based on the following criterion:

1. Relatedness of the businesses

2. Type of customers – retail or industrial

3. Employee remuneration differentials

4. Core competencies required by board members/ top management.

Based on this model, I suggested that 4 entities should be formed:

1. Steel and Industrial Equipments

2. Real Estate

3. Pharma

4. Insurance and Financial Services Distribution

N seemed happy with the answer and ended the case and started the PI.

What I think went right for you in the interview

I think I managed the situation well considering I had never done a case like this before and that Finance was not my forte. Thinking logically helped.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

Don’t let external factors affect your performance. Many things can happen on Day 1 that you would have never expected, but its important to keep your calm and think logically if get stuck.

Outcome

Made it to the next round

Company: XYC, Interview No. 2

Interviewer: A, Partner

Personal Interview Questions

This was a PI first interview. The PI questions mostly revolved around 2-3 key themes:

1. Why do you want to join XYC? – had a well prepared answer for that

2. Why XYC over Burger? – again, since XYC was my first choice, I had a well prepared answer for that. Interestingly, I mentioned about 2 alums and said that I wanted to become like them. He was impressed and said that he has worked with one of them and having a target to become like him was awesome because he felt that guy was a superstar (these were the words he used). So he seemed pretty impressed with my answer.

3. Long term goal – talked about improving Indian Hockey and opening up an NGO.

Any questions – I asked him for his most satisfying moment in XYC

Case Question

A South-Korean TV manufacturer wants to enter the US market, like LG and Samsung have entered the US market in the past. As of now it is a regional player, operating mostly in SE Asia.

Should it enter the US? If yes, how should it enter?

Case Type

Market Entry / Market Sizing Case

Narration of the Case

I asked a few clarifying questions:

1. What was the motive of entry to the US market? – A told me it could be anything, it could be profits, and it could be ego.

2. If at all we enter the US market, what’s would the manufacturing model look like? Would we manufacture in SE Asia and ship to US or set up manufacturing base in US? – he said its open for discussion during the case.

I asked for a minute to structure the case and came up with the following structure:

1. Fundamental Analysis

a. Market Size

b. Growth Rate

c. Level of Competition

d. Market Share

e. Pricing Power (Demand and Supply gap)

f. Investments required

This was the first part of the analysis where I said I will first evaluate the US TV market as it is, and see if it is profitable for anyone. I told him I wanted to project the revenues and profits for our client. He asked me what would be costs involved and listed the following broad categories:

a. Investment Cost (cost of capital)

b. Marketing Expenses

c. SGA

d. Transportation Costs (depending upon the model of operation)

2. Synergies/ Other benefits (benefits which were specific to our client)

a. Brand

b. Economies of Scale

c. Sourcing Scale

d. Real Options

3. Key Resources Required/ Key Success Factors

4. Creating sustainable advantage – once entered what all should be done to build sustainable advantage

5. Mode of entry

a. Organic Growth

b. Acquisition

c. Alliance

d. JV

e. Off-shore manufacturing

A seemed happy with the structure and changed the case here a bit. He asked me estimate the no. of TVs in use in the US.

I told him that we need to first find out the no. of households in US to estimate the no. of TVs. For this I said we can take the population of USA and divide by the average no. of people per household. A told me to proceed with the calculation. I told the population of USA would be around 500 million. A corrected me saying it was 300 million. I took the average family size as 3 and came up with 100 million households. Then I told him that I would divide the households on the basis of their income:

a. Low income – 30% = 30 million

b. Medium income – 60% = 60 million

c. High Income – 10% = 10 million

Then I said I would take an average of 1 TV per household for the low income category and 2 TVs per household for the medium and high income category. This way I came up the total base of televisions in US. A asked me estimate the new demand for TVs. I structured this part in two categories:

1. Demand due to growth in population – A told me that population growth was negligible in US and could be ignored.

2. Replacement Demand – A asked me to estimate the replacement demand.

I again went back to the categorization of households and estimated the average life of TVs in each of the categories:

a. Low income – 8 years

b. Medium income – 5 years

c. High Income – 2 years

Based on this I told him we can estimate the total no. of new TVs required each year. I also told him that the dollar size of the TVs would depend on the kind of TVs each of these households would purchase, which again can be estimated by taking a different average price per TV for each of the three categories of households. A seemed happy with the analysis and asked me to guess the 3 largest non-household markets for TVs in USA. I told him:

a. Restaurants/ Pubs

b. Broadcasting Networks/ TV Channels

c. Plasma screens in airplanes

He told me I missed the largest market, which was Hotels/ Hospitals, but also me that I did the case very well and should not worry about it. A ended the case here.

What I think went right for you in the interview

I think I structured each mini problem that came up during the case very well, and A was visibly impressed by the way I took a structured approach to solving problems.

What I think went wrong in the interview

Made two errors:

1. Wrong estimate for the population of USA

2. Could not come up with Hotels as a potential market for TVs

Tips for the future batch based in this interview

Get your basic GK right on population, languages, per capita income etc. of various countries before going for the interviews. It would help.

Outcome

Made it to the next round

Company: XYC, Interview No. 3

Interviewer: R, Partner

Personal Interview Questions

This was a case first interview. After the case the PI began.

The first thing R asked me was how my day had been so far. And I told him that it had not been good, especially not the way I expected it to be. He asked me why and I told him about my Burger experience, where I was stuck for 5 hours. I told him that I left the Burger interview in between and came for the XYC interview. R asked me why I did so. I told him what actually happened that day why I came to XYC. He asked me why XYC? I told him that in a sense I had already made the choice by skipping the Burger interview and coming to the XYC interview.

Standard last question, he asked me if I had any questions. I asked him a question on the difference in culture across various organizations in various countries, since he had worked in several countries.

The entire discussion lasted for 15 minutes.

Case Question

Our client is a Cement manufacturing company, and wants to improve it’s profit/ton of cement. What should it do?

Case Type

Profitability Case

Narration of the Case

I asked a few clarifying questions:

1. How many plants does this company have? – 10

2. What were the markets it was operating in? – it operated pan India, and sold its cement in 450 districts

3. How many types of cement did the company produce? – only 1. R asked me to assume that there is only 1 type of cement available in the market as well.

4. What type of customers did the company have- institutional or retail? – retail

5. Was the price of cement same in all markets? – No. Each district had a different price and hence a different profit. R also added that in each individual market it was a price taker.

After this set of clarifying questions, I defined the problem and started analyzing the problem. For the analysis, I made a very simple structure:

Profits/Ton were a function of:

a. Capacity Utilization

b. Revenues

c. Costs

To this R told me that Capacity Utilization was 100% at each of the 10 plants the company owned. I told R that since the market was a price taker’s market, there was no scope to increase the further. Further, since there was only one type of cement, there was no scope for product differentiation as well. Hence, the only option was to reduce the cost.

I asked R how the company was faring w.r.t. to its competitors on cost of manufacture of cement. R told me that they were at par with other players in the markets w.r.t. the cost of manufacture.

To this effect, I suggested writing a Linear Programming equation to optimize the transportation costs across various districts. It seemed R was looking for this answer, and he asked me write the LP. I asked for minute and then wrote the LP, including the Objective Function and the Constraints. It too longer than expected and was not as simple as I thought. Thankfully, I wrote the equation and R was impressed. I suggested that our client should redistribute the volume to various districts from the 10 factories based on the outcome of the LP optimization.

R asked me should the client do exactly what the LP suggested or should he keep some other factors in mind. To this I told him that the client also needed to keep some other factors in mind, like:

a. Market Size and Future Growth rate

b. Demand Supply Gap, and hence pricing power in future

c. Real Options, i.e. exiting a market totally may not be good option even if the LP suggested so.

d. Competitive Response, including where their factories are located and how much excess capacity they have, how much they plan to build in the recent years etc.

R seemed okay with the answer and proceeded with the PI.

What I think went right for you in the interview

I structured the problem well, and covered capacity utilization as well, which is generally not covered in the profitability cases.

Also, I wrote the LP very comprehensively, which included the objective function as well as the constraints. I got stuck in between while writing the LP because it was a complicated one, but I took my time and eventually came with the correct LP.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

Practice few cases on LP. By practice I mean complete practice where in you write the full LP Objective Function as well the constraints. It will help should a similar question comes up during the interview.

Be truthful during the interview, and say what you feel. From my experience, this is very much appreciated. Also, treat the interview as a discussion and not as an Q&A session.

Outcome

Made it to the next round

Company: XYC, Interview No. 5

Interviewer: IA, Partner (I had one more interview in between which I do not remember now)

Personal Interview Questions

This was again a case first interview. After the case, IA started the PI. Following were the questions he asked:

1. How was my experience at ITC – I talked a lot including things that I liked about ITC and things that I didn’t.

2. How was my experience at ISB – again, I spoke about lot of positive things and some negative things. He seemed to like that I took a balanced approach while answering the questions.

3. Asked about my Hockey and if I was still playing – I told him that I didn’t play Hockey after IIT. However, I was playing football at ISB.

4. Asked about my goals in life – I told him about my short term and long term goals, which I had prepared and vetted with Alums.

5. Any question for him – I don’t remember what I asked him

Entire thing lasted for about 10-12 minutes.

Case Question

Our client is a Telecom service provider like Airtel. It wants us to evaluate two things:

1. Wants us to evaluate the competitive scenario in the market

2. What dimensions should it benchmark its performance against its competitors

Case Type

Telecom Benchmarking Case

Narration of the Case

The case was very vague and I was little confused how to begin. The first thing I asked him was why the client wanted us to undertake the case. IA answered that our client wanted to evaluate where it is viz. a viz. its competitors and wants to do the same on a continuing basis. Hence the case.

We had a discussion on the Telecom market in general and gave my views on the same. Post this he asked me to solve the benchmarking issue. I made a very simple structure for the benchmarking purpose which was based on 4 key parameters:

1. Profitability – obviously, to survive in the competitive telecom industry, profitability needs to be benchmarked against completion

2. Costs – the various costs the company incurs also need to be benchmarked to as to sustain advantage, especially given the market scenario of declining tariffs

3. Distribution/ Network – to have a sustainable advantage, the network and distribution, including access to towers in already serviced as well potential growth areas needs to be benchmarked

4. Access to technology – with the advent of services like 3G, the access to upcoming technology also needs to be benchmarked.

IA seemed to be happy with structure and ended the case. This was very short case, and lasted hardly 15 minutes.

What I think went right for you in the interview

I had certain opinions regarding the Telecom industry, which helped a lot during the discussion on the industry. Also, while solving the case, I structured the case well.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

You need to have an opinion on the key industries and sectors, as in what are the current trends, what is happening right, what is not happening right, what you would change if you had the power, your recommendations about the industry etc.

Outcome

Made it to the next round

Company: XYC, Interview No. 6

Interviewer: H, Partner

Personal Interview Questions

This interview started which started with a case, followed by a PI, and then again a case. I will mention about the first case here itself, because the PI was driven mostly by the answers I gave in the case.

He started the interview by asking why had the stock of HUL been stable at Rs. 200 per share for the last 10 years, whereas stock prices of other FMCG companies over the same time period had risen (the question came because I was from the FMCG background).

I started the analysis of the case by saying that I would benchmark HUL strategies against some of the other FMCG companies whose stock prices had risen. I took ITC as the benchmark, because I was working for ITC and evaluated HUL vs. ITC strategies on various levels. At this point the discussion become qualitative and H kept asking for my opinions, and I thought it became more of a PI than a case. When asked about my opinion on what was the primary reason for HUL stock prices not growing, I told him that I felt the HUL strategy of master-brands, i.e. eliminating various smaller brands into single umbrella brands was a wrong strategy for the Indian market. I told H that in the Indian market, there are various types of consumers with varying needs, and to have one brand catering to all segments may not be a good idea.

At this point, H asked me about my opinion on the ITC FMCG strategy. I gave some plus points, but H asked me what I thought ITC was not doing right. I told him that I felt that the names of the products Vivel, Fiama etc. were too foreign and unfamiliar, and maybe ITC was going wrong here. H told me that Lux and Lifebuoy, the largest selling soap brands also had foreign names. I told H that Lux and Lifebuoy have been around for such a long time that the names may not appear foreign to the Indian consumer anymore. I also added that I did not like the idea that ITC ended all its product names with WILLS, e.g. Fiama Di Wills, and there were many consumers who still attach the name WILLS with cigarettes and there are many people who would not buy the product just because of that.

H asked me how the reaction at my home was when I decided to join ITC, a company which apparently sells cancer. I gave him the standard ITC answer, which is ingrained into your head the moment you join ITC. H said he completely agreed with whatever I said. He then asked me about my long term goal. I told him that fortunately or unfortunately, I know that I don’t know what I want to do in the long term. However I had some tentative plan and I told him about Indian Hockey and my plan to set up an NGO. We had a small discussion on why I had these goals and I backed it up well, linking both back to previous experiences.

He then asked me if I had some questions, and I asked him what kept him going in the consulting career for so long. Again, there was a small discussion, but this time he was the one doing most of the talking.

He then gave me another case.

Case Question

H told me that there was new phenomenon that was emerging in the US. In the US, there are certain people who spot basketball and baseball players very early in age and pay them a lump sum amount when they are very young in return of a certain percentage of their lifetime earnings. H told me that our client wants to do the same for budding cricketers in India, and our job was to help him figure out what the lump sum amount should be how much percentage of lifetime earnings they should demand.

Case Type

Valuation Type Case (vaguely related to valuation actually)

Narration of the Case

The case was a vague one and I tried to structure it in some way. Since there were two parts to the problem, I decided to handle the two parts separately.

First part was to determine the lump sum amount. For this I told H that we needed to forecast the potential earnings of the selected cricketer and discount it back to the current date to get the NPV. This problem in structured in the following way:

1. Judging the potential – this would determine the potential income greatly. E.g. A Sachin Tendulkar would earn much more than VVS Laxman. Hence, the first step would be to identify the true potential. I suggested that we can use a comparable approach or expert opinion for the same.

2. Forecasting the future earnings:

a. Earning from core activities – match fees, board contracts etc.

b. Earnings from non-core activities – endorsements, advertisements etc.

Once we have identified the potential, we can estimate how much the cricketer of his caliber can earn in future.

3. Selecting the Discount Rate – since this was a very risky investment, as the potential earnings were not sure, subject to injuries etc., I suggested we use a high discount rate, of the order of 30-40% for discounting the earnings.

4. How much of the NPV should we pay to the cricketer – here we could take a percentage of the NPV (i.e. percent of the NPV we would get) or use a high discount rate incorporating all risks and pay the entire NPV(percent of the NPV we would get) to the cricketer.

The second part was to determine what percentage of lifetime earnings we should demand. Here I said it was essential to optimize the percentage of the earnings, because if the percentage of total earnings that we would in future is very high then there would be no incentive for the cricketer to perform. He might indulge in drugs, drinking etc. and may not pay attention to practice. Hence it was essential keep enough incentive for the cricketer to perform as well. To this, H asked me to draw the graph of upfront payment versus the percentage of total earnings that we would get. I drew the following graph:

Basically through the graph I intended to say that the upfront payment would plateau after a certain point, beyond which we should not pay any extra for any additional percentage of total income.

H seemed happy with the analysis and ended the case.

What I think went right for you in the interview

I think I structured a seemingly vague case reasonably well, which paid off. Also, the point that a higher percentage of total income would mean no incentive for the cricketer to perform was highly appreciated by H.

What I think went wrong in the interview

I did not handle the question of ITC FMCG strategy as well as I should have, especially as I was working for ITC. I should have been better prepared for that kind of a question.

Tips for the future batch based in this interview

Be very well prepared about the industry you were working in, including their current strategy, what they are doing right and what they are doing wrong, what you would have done differently etc.

Outcome

Was made the Offer!

Company: Burger, Interview No. 1

Interviewer: R, Principal

Personal Interview Questions

This was a very unique interview. The case started with a PI, followed with 3 cases. The PI questions are as follows:

1. Tell me about yourself

2. Biggest accomplishment

Then he asked me about Hockey (since I used to play Hockey in college) and enquired what was wrong with Indian Hockey, especially in light of the recent fiasco. I asked if this was a case, and he said I can take it as a case or give my opinion about it. I gave him my opinion on the issue. He then told solve the problem of Indian Hockey as a case.

Case Question

What should be done to improve Indian Hockey?

Case Type

Indian Hockey Case / Estimation/ Revenue Stream Identification

Followed by market size estimation of Tata Nano

Narration of the Case

I made simple Input->Process->Output structure, saying that the root of the problem was poor performance by the National team in international competitions. From the structure, it was clear that the output was poor, hence there must a problem in the input or the process. So I listed the various inputs like player quality, selection criterion, coach quality, domestic tournaments, prevalence of hockey in schools etc. In the process I listed training programs, coaching programs, coach training programs, infrastructure, availability of funding etc. We had a long discussion and the outcome was that the major problem in India was lack of Astroturfs, because of which the performance of players was weak in international events.

Post this R asked me how much does it cost to build and Astroturf. I knew that and told him the answer. He asked me what can be done so that this expense on Astroturf can be made self sustainable. I made a structure of Core Assets and Non-Core assets and identified revenue streams for both. For core assets, which were the turf itself, we identified avenues like renting for practice, local tournaments, school competitions etc. Non-Core assets were the property and land we would own around the turf, which can used for advertisements, leasing for juice-shops, food stalls etc.

R then asked me estimate the no. of Astroturfs are required in India for Indian hockey to improve. I said we can benchmark the no. of Astroturfs/ Sq. Km against a country which was doing well in world hockey, say Germany. On this we had a long discussion that Astroturfs/ Sq. Km may not be feasible comparison criterion considering the size and population density differential of India and Germany. Then I suggested we use a criterion of minimum distance to Astroturf as a criterion and compare it with Pakistan, which had similar population density but was performing much better than India in Hockey. R was okay with the answer.

To my surprise, I was given one more case to solve after this (considering the last case with already lasted more than an hour). R asked me to estimate potential market for Tata Nano in India. I made a standard market sizing top-down estimate, starting from population, income segments, population in target income segment, percentage conversion, cannibalization from cars like Maruti 800 and Alto, Upgrades from bikes, cannibalization from autos and taxis.

What I think went right for you in the interview

On the whole I think this was a very long interview and I kept my composure throughout. Also, I knew facts about Indian Hockey, like costs of Astroturf etc. which helped a lot.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

Read up on things that are there on your resume, especially if there is some current hot news on the same.

Outcome

Made it to the next round

Company: Burger, Interview No. 2

Interviewer: GR, Partner

Personal Interview Questions

GR started the PI picking on a particular point on my Resume where I had mentioned that I became the youngest HOD at ITC. He asked me if that was by luck or by something that I did. I told him that obviously luck was involved to an extent that the position was vacant at that time, but since there were 40 others who could have been given the role and given the fact that I was chosen obviously means that I must have done something good.

He then asked me a few questions on my work experience:

1. Biggest achievement at work

2. Issues when handling a unionized workforce

3. Biggest learning

4. Why MBA – I told him that the more pertinent question would be why MBA at this time and gave him a very well prepared answer.

At this point he ended the PI and went into the case.

Case Question

GR asked me to price a Hovercraft Service between 2 points in Mumbai (forgot the 2 points, am not very familiar with Mumbai geography). Following if the information that he provided (all one way costs):

1. A train between the 2 locations takes 45 min. , and costs Rs. 45

2. Taxi takes between 90-100 min., costs Rs. 450

We have 1 Hovercraft, it takes 20 min., seating capacity is 100 and it provides A.C. comfort.

Case Type

Pricing Case

Narration of the Case

I asked if there was some information on the demand supply gap, which could help in determining how much we could charge for the service. GR told me that no such information was available. I told GR that we can price the service as per three methods:

1. Cost Plus Pricing

2. Value Based Pricing

3. Competition Based Pricing

GR told me that for Cost Plus Pricing, the costs of the service for a one way turned out to be Rs. 700 per person (including required returns). He asked me if that price was a good price to keep for the service.

I enquired about the demand again. He told me that the demand was equivalent to 10,000 people/day. I then asked GR how many trips was the Hovercraft capable of doing in an hour. He gave me some information on the same: it took 5 min. for loading people and another 5 min. for unloading people, in addition to the 20 min. travel time. That meant 2 trips/ hr. for the Hovercraft. I also assumed 20 hrs of operation during a day making a total of 40 trips in a day. Remaining 4 hrs could be used for maintenance. However, of these 40 trips, only half were one way, the other half were return trips. Hence, only 20 trips / day for the one way trip was possible. With 100 people seating capacity, this meant a total capacity of 2000 people per day.

I told GR that since the total demand was 10,000 people per day, we needed to plot the demand curve and see how many people have the willingness to pay more than Rs. 700. If this no. was more than 2000, we can go ahead with the price. GR seemed okay with the answer and ended the case.

He asked me if I had any questions. Since GR was leading the Industrial and Operations practice, I asked him a few questions on the same.

What I think went right for you in the interview

The case was pretty straightforward, and there wasn’t much scope of error. However, the PI I thought was pretty quizzical and GR seemed very skeptical about the answers I gave. The good thing was that I kept my cool and backed my answers pretty well.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

If you get a skeptical interviewer, do not get perturbed. Be confident and truthful, and back your answers well. Be prepared for cross questioning and defending your answers. Preparation of this in your prep group helps a lot.

Outcome

Made it to the next round. However, did not attend any further interviews because of schedule clashes with my XYC interviews. Decided to attend the XYC interviews since XYC was my first preference.

Company: Pearl, Interview No. 1

Interviewer: V, Managing Director

Personal Interview Questions

This was a typical PI first interview followed by a case. V started by saying that I had an excellent academic record and he was really impressed with my resume (made me feel happy). He then asked me about my work experience at ITC, and specifically asked me about both good and bad things in ITC according to my opinion. I gave an honest answer, and he agreed with the most part. He then asked me about my most significant achievement which I very easily answered. He then moved to the case.

Case Question

V first gave me a background of the TV industry. He told me about channels and broadcasters and told me that the bulk revenue source in the industry was advertising revenues. He then told me about a legislation that mandated a maximum of 10 min./hr of advertisements. He then told me that suppose STAR TV was our client, and had a no. of channels. For one of the channels, STAR ONE, the advertising revenues had remained flat at Rs. 500 Cr., whereas the market has grown during the same time by 10-15% a year. Our job was to identify why the revenues had stayed flat.

Case Type

Flat Revenues in Media Industry

Narration of the Case

I made a very simple structure, saying that revenues were a function of price and volume, and hence I wanted to look at the following items during the analysis:

1. Utilization of the available ad time – V told me that the utilization of paying clientele was stable at 50-60%, however the industry average was around 80%. The remainder time was filled with own commercials.

2. Price of ad per sec – V told me that the realized price per sec of ad was going up for the industry, but for their channel it remained the same.

I delved further into the issue by asking why this was the case, i.e. why the realized price had remained constant. V said he needed me to help him on this. I tried to indentify the drivers of the Price of Ad per sec, and came up with the following factors:

1. TRPs of the programs

2. Targeting of ads as per customer segment

3. Perishability of the product – hence whether a dynamic rate structure was being used as in the case of airlines.

There was some discussion on each of the issues, and here V was doing most of the talking. He told me about his experiences in the Media and Advertisement industry. Then we had a very interesting discussion on how TV channels were circumventing the legislation of Max. 10 min. ads per hour by using tickets, inlets etc. I asked him if he expected legislation on this issue, and he told me yes he did. He then ended the case and asked me if I had any questions. I asked him some questions in his field of work.

What I think went right for you in the interview

The case was pretty easy and hence everything went right (partly because very recently I had done a very similar case, thanks to Rishi Dogra)

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

Practice cases from various industries. You don’t know how much it helps if you are slightly familiar with the industry.

Outcome

Made it to the next round

Company: Pearl, Interview No. 2

Interviewer: G, Principal

Personal Interview Questions

The PI was extremely short, and was rather weird. This was the only interview where I was asked about my failures in life. Nevertheless, since this was a standard interview question I was prepared for this. I gave him my answer and G followed it up with my learnings out of those failures. Again I was prepared for this and gave him a very well prepared answer. He ended the PI and started the case.

Case Question

Estimate the no. of parking slots required for a 500 bed hospital

Case Type

Estimation Case

Narration of the Case

First I identified the various categories of vehicles for which parking would be required in the hospital and came up with four major categories:

1. Patients/ Relatives

2. Doctors

3. Support Staff

4. Sales People

Then I estimated the no. of spots required for each of the 4 categories separately.

Patients – divided them into two parts, admitted and outdoor

No. of Parking spots required (admitted patients) = No. of Beds * Avg. Occupancy Rate * % of people coming in own vehicles. Assumed some nos. for each, 500 * 90% *50% = 225

No. of Parking spots required (outdoor patients) = No. of Beds * No. of doctors per bed * Avg. no. of people a doctor sees in 1 hr * % of people coming in own vehicles. Assumed some nos. for each, 500 * (1/10) * 4 *50% = 100

Total no. of parking slots required for patients = 225 + 100 = 325

Doctors – already deduced above that there are around 50 doctors in the hospital. Assumed further that at any time maximum 2/3 of these doctors would be at the hospital. Also, I assumed that all doctors would come in the own cars. Hence, parking spots required for doctors = 32

Support Staff

No. of Parking spots required (support staff) = No. of Beds * No. of support staff per bed * % of people coming in own vehicles. Assumed some nos. for each, 500 * 1 *20% = 100

Sales People

No. of Parking spots required (sales people) = (No. of Doctors * No. of visits per doctor per month * % of people coming in own vehicles)/30 . Assumed some nos. for each, 50 * 4 * 30%/30 = 2

Hence total parking spots required = 460 (approx.)

G pointed out that my approach was good, but I did not ask where the hospital was located, because the figures of percentages on no. of people coming in own vehicles would depend very much on the location. E.g. if it was USA, all those figures would be 100%, and if it was some remote location in India it would be close to zero. He said I inherently assumed the hospital would somewhere in Bombay, for which the numbers made sense.

I agreed and he ended the case. He asked me if I had any questions, and I asked him some questions related to his work again.

What I think went right for you in the interview

I hadn’t practiced estimation cases too much, but managed to structure the problem sufficiently well and break it into sub problems. As G also said, the approach was good.

What I think went wrong in the interview

As pointed out earlier, I did not ask too many questions upfront, and hence missed the question on the location of the hospital. In my opinion that was a very basic error.

Tips for the future batch based in this interview

Practice estimation cases enough. In our batch in general the preparation for estimation cases was a little low, but many people got estimation cases in their interviews, especially in the first found.

Outcome

Made it to the next round

Company: Pearl, Interview No. 3

Interviewer: BR, Partner

Personal Interview Questions

This was a very standard PI and had all standard questions. BR started by saying that he liked my resume and then went on to ask the following questions:

1. Tell me about myself. Standard question – standard well prepared answer

2. Why consulting – standard well prepared answer

3. How many shortlists I had – I knew this was going to be a tricky question. I told him that I had 8 shortlists on day 1, including the top consulting firms.

4. Then the tough question – why Pearl? I gave an answer which I had prepared. However, he asked me which company I would join if I got offers from Pearl, XYC and Burger. I told him I would join Pearl and gave a good explanation based on what I had read about the firm on the website. Preparation actually helps! The good thing was BR was very supportive and he told me I must interview with the other firms and that would help me understand the firms better and make a well informed. I was impressed with the maturity the firm showed, from which other larger firms can definitely learn.

This was quite a long discussion; post which he started the case.

Case QuestionBR told me that he had a friend who was thinking of launching High Quality Auto Service centers which would provide high quality service to 4 wheelers at low cost. Basically the service center would be one stop shop for all car needs. Also, he would use these centers to sell used cars. He would buy used cars, refurbish them and sell through these centers. He had a pan India launch plan, and BR wanted me to estimate the size of the opportunity.

Case Type

Market Sizing

Narration of the Case

I told BR that to evaluate the size of the opportunity, we first needed to divide the cities into Tier 1, Tier 2 and Tier 3 cities because the estimates would be different for each city. BR agreed. Then I went ahead and identified the various revenue streams that would exist for the service station and came up with the following broad categories:

1. Maintenance

2. Repair

3. Spare Parts Sale

4. Insurance

5. Used car sale

Then for each Tier of cities, estimate the no. of cars in the city, split by make. Once the split by make is available, we can estimate the average maintenance cost per car. This in turn would help us estimating repair and spare parts cost. BR stopped me here saying I was approaching the problem the right way and he wanted to me think on what could be challenges involved in setting up such Auto centers. I told him that there are 2 broad challenges:

1. Low cost vs. Differentiation Strategy – basically our client was trying to follow the low cost as well as differentiation strategy together. I felt the biggest challenge was to remain profitable by providing higher quality service, better atmosphere and environment at a lower cost.

2. Resistance from local garages – if at all the business is successful, there would be immense resistance from local garages because you would basically end their sources of revenue. Protests and Violence could not be ruled out. Gave him the example of Reliance Fresh when it started and how its stores were vandalized by local vegetable vendors.

BR was happy with my answer and asked me if I had any questions. I asked him some probing question on the case itself and how actually this can be implemented and someone was doing it.

What I think went right for you in the interview

Again, it was not a very difficult case. So I think I did well.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

Be prepared to answer questions like why me over some other consulting firm. The key here is to give a very specific and tailor-made answer rather than a general global gyan answer. Just needs preparation, that’s it. You wont be able to think of a good answer there, especially under that heavy Day 1 pressure.

Outcome

I was told that I would be made the offer if I signed out of the placement process at that itself. I said I needed some time, and they gave me. Meanwhile I got the XYC offer, and hence informed them about the same.

Thus, I conclude another pretty long article of mine. And also promise that this would be last of the epic articles. This would also be the last of the "Free Advice" articles. As always, if anyone reading needs any clarification - drop me a line. I would be more than happy to help.

Interviewer: A, Partner

Personal Interview Questions

This was a PI first interview. The PI questions mostly revolved around 2-3 key themes:

1. Why do you want to join XYC? – had a well prepared answer for that

2. Why XYC over Burger? – again, since XYC was my first choice, I had a well prepared answer for that. Interestingly, I mentioned about 2 alums and said that I wanted to become like them. He was impressed and said that he has worked with one of them and having a target to become like him was awesome because he felt that guy was a superstar (these were the words he used). So he seemed pretty impressed with my answer.

3. Long term goal – talked about improving Indian Hockey and opening up an NGO.

Any questions – I asked him for his most satisfying moment in XYC

Case Question

A South-Korean TV manufacturer wants to enter the US market, like LG and Samsung have entered the US market in the past. As of now it is a regional player, operating mostly in SE Asia.

Should it enter the US? If yes, how should it enter?

Case Type

Market Entry / Market Sizing Case

Narration of the Case

I asked a few clarifying questions:

1. What was the motive of entry to the US market? – A told me it could be anything, it could be profits, and it could be ego.

2. If at all we enter the US market, what’s would the manufacturing model look like? Would we manufacture in SE Asia and ship to US or set up manufacturing base in US? – he said its open for discussion during the case.

I asked for a minute to structure the case and came up with the following structure:

1. Fundamental Analysis

a. Market Size

b. Growth Rate

c. Level of Competition

d. Market Share

e. Pricing Power (Demand and Supply gap)

f. Investments required

This was the first part of the analysis where I said I will first evaluate the US TV market as it is, and see if it is profitable for anyone. I told him I wanted to project the revenues and profits for our client. He asked me what would be costs involved and listed the following broad categories:

a. Investment Cost (cost of capital)

b. Marketing Expenses

c. SGA

d. Transportation Costs (depending upon the model of operation)

2. Synergies/ Other benefits (benefits which were specific to our client)

a. Brand

b. Economies of Scale

c. Sourcing Scale

d. Real Options

3. Key Resources Required/ Key Success Factors

4. Creating sustainable advantage – once entered what all should be done to build sustainable advantage

5. Mode of entry

a. Organic Growth

b. Acquisition

c. Alliance

d. JV

e. Off-shore manufacturing

A seemed happy with the structure and changed the case here a bit. He asked me estimate the no. of TVs in use in the US.

I told him that we need to first find out the no. of households in US to estimate the no. of TVs. For this I said we can take the population of USA and divide by the average no. of people per household. A told me to proceed with the calculation. I told the population of USA would be around 500 million. A corrected me saying it was 300 million. I took the average family size as 3 and came up with 100 million households. Then I told him that I would divide the households on the basis of their income:

a. Low income – 30% = 30 million

b. Medium income – 60% = 60 million

c. High Income – 10% = 10 million

Then I said I would take an average of 1 TV per household for the low income category and 2 TVs per household for the medium and high income category. This way I came up the total base of televisions in US. A asked me estimate the new demand for TVs. I structured this part in two categories:

1. Demand due to growth in population – A told me that population growth was negligible in US and could be ignored.

2. Replacement Demand – A asked me to estimate the replacement demand.

I again went back to the categorization of households and estimated the average life of TVs in each of the categories:

a. Low income – 8 years

b. Medium income – 5 years

c. High Income – 2 years

Based on this I told him we can estimate the total no. of new TVs required each year. I also told him that the dollar size of the TVs would depend on the kind of TVs each of these households would purchase, which again can be estimated by taking a different average price per TV for each of the three categories of households. A seemed happy with the analysis and asked me to guess the 3 largest non-household markets for TVs in USA. I told him:

a. Restaurants/ Pubs

b. Broadcasting Networks/ TV Channels

c. Plasma screens in airplanes

He told me I missed the largest market, which was Hotels/ Hospitals, but also me that I did the case very well and should not worry about it. A ended the case here.

What I think went right for you in the interview

I think I structured each mini problem that came up during the case very well, and A was visibly impressed by the way I took a structured approach to solving problems.

What I think went wrong in the interview

Made two errors:

1. Wrong estimate for the population of USA

2. Could not come up with Hotels as a potential market for TVs

Tips for the future batch based in this interview

Get your basic GK right on population, languages, per capita income etc. of various countries before going for the interviews. It would help.

Outcome

Made it to the next round

Company: XYC, Interview No. 3

Interviewer: R, Partner

Personal Interview Questions

This was a case first interview. After the case the PI began.

The first thing R asked me was how my day had been so far. And I told him that it had not been good, especially not the way I expected it to be. He asked me why and I told him about my Burger experience, where I was stuck for 5 hours. I told him that I left the Burger interview in between and came for the XYC interview. R asked me why I did so. I told him what actually happened that day why I came to XYC. He asked me why XYC? I told him that in a sense I had already made the choice by skipping the Burger interview and coming to the XYC interview.

Standard last question, he asked me if I had any questions. I asked him a question on the difference in culture across various organizations in various countries, since he had worked in several countries.

The entire discussion lasted for 15 minutes.

Case Question

Our client is a Cement manufacturing company, and wants to improve it’s profit/ton of cement. What should it do?

Case Type

Profitability Case

Narration of the Case

I asked a few clarifying questions:

1. How many plants does this company have? – 10

2. What were the markets it was operating in? – it operated pan India, and sold its cement in 450 districts

3. How many types of cement did the company produce? – only 1. R asked me to assume that there is only 1 type of cement available in the market as well.

4. What type of customers did the company have- institutional or retail? – retail

5. Was the price of cement same in all markets? – No. Each district had a different price and hence a different profit. R also added that in each individual market it was a price taker.

After this set of clarifying questions, I defined the problem and started analyzing the problem. For the analysis, I made a very simple structure:

Profits/Ton were a function of:

a. Capacity Utilization

b. Revenues

c. Costs

To this R told me that Capacity Utilization was 100% at each of the 10 plants the company owned. I told R that since the market was a price taker’s market, there was no scope to increase the further. Further, since there was only one type of cement, there was no scope for product differentiation as well. Hence, the only option was to reduce the cost.

I asked R how the company was faring w.r.t. to its competitors on cost of manufacture of cement. R told me that they were at par with other players in the markets w.r.t. the cost of manufacture.

To this effect, I suggested writing a Linear Programming equation to optimize the transportation costs across various districts. It seemed R was looking for this answer, and he asked me write the LP. I asked for minute and then wrote the LP, including the Objective Function and the Constraints. It too longer than expected and was not as simple as I thought. Thankfully, I wrote the equation and R was impressed. I suggested that our client should redistribute the volume to various districts from the 10 factories based on the outcome of the LP optimization.

R asked me should the client do exactly what the LP suggested or should he keep some other factors in mind. To this I told him that the client also needed to keep some other factors in mind, like:

a. Market Size and Future Growth rate

b. Demand Supply Gap, and hence pricing power in future

c. Real Options, i.e. exiting a market totally may not be good option even if the LP suggested so.

d. Competitive Response, including where their factories are located and how much excess capacity they have, how much they plan to build in the recent years etc.

R seemed okay with the answer and proceeded with the PI.

What I think went right for you in the interview

I structured the problem well, and covered capacity utilization as well, which is generally not covered in the profitability cases.

Also, I wrote the LP very comprehensively, which included the objective function as well as the constraints. I got stuck in between while writing the LP because it was a complicated one, but I took my time and eventually came with the correct LP.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

Practice few cases on LP. By practice I mean complete practice where in you write the full LP Objective Function as well the constraints. It will help should a similar question comes up during the interview.

Be truthful during the interview, and say what you feel. From my experience, this is very much appreciated. Also, treat the interview as a discussion and not as an Q&A session.

Outcome

Made it to the next round

Company: XYC, Interview No. 5

Interviewer: IA, Partner (I had one more interview in between which I do not remember now)

Personal Interview Questions

This was again a case first interview. After the case, IA started the PI. Following were the questions he asked:

1. How was my experience at ITC – I talked a lot including things that I liked about ITC and things that I didn’t.

2. How was my experience at ISB – again, I spoke about lot of positive things and some negative things. He seemed to like that I took a balanced approach while answering the questions.

3. Asked about my Hockey and if I was still playing – I told him that I didn’t play Hockey after IIT. However, I was playing football at ISB.

4. Asked about my goals in life – I told him about my short term and long term goals, which I had prepared and vetted with Alums.

5. Any question for him – I don’t remember what I asked him

Entire thing lasted for about 10-12 minutes.

Case Question

Our client is a Telecom service provider like Airtel. It wants us to evaluate two things:

1. Wants us to evaluate the competitive scenario in the market

2. What dimensions should it benchmark its performance against its competitors

Case Type

Telecom Benchmarking Case

Narration of the Case

The case was very vague and I was little confused how to begin. The first thing I asked him was why the client wanted us to undertake the case. IA answered that our client wanted to evaluate where it is viz. a viz. its competitors and wants to do the same on a continuing basis. Hence the case.

We had a discussion on the Telecom market in general and gave my views on the same. Post this he asked me to solve the benchmarking issue. I made a very simple structure for the benchmarking purpose which was based on 4 key parameters:

1. Profitability – obviously, to survive in the competitive telecom industry, profitability needs to be benchmarked against completion

2. Costs – the various costs the company incurs also need to be benchmarked to as to sustain advantage, especially given the market scenario of declining tariffs

3. Distribution/ Network – to have a sustainable advantage, the network and distribution, including access to towers in already serviced as well potential growth areas needs to be benchmarked

4. Access to technology – with the advent of services like 3G, the access to upcoming technology also needs to be benchmarked.

IA seemed to be happy with structure and ended the case. This was very short case, and lasted hardly 15 minutes.

What I think went right for you in the interview

I had certain opinions regarding the Telecom industry, which helped a lot during the discussion on the industry. Also, while solving the case, I structured the case well.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

You need to have an opinion on the key industries and sectors, as in what are the current trends, what is happening right, what is not happening right, what you would change if you had the power, your recommendations about the industry etc.

Outcome

Made it to the next round

Company: XYC, Interview No. 6

Interviewer: H, Partner

Personal Interview Questions

This interview started which started with a case, followed by a PI, and then again a case. I will mention about the first case here itself, because the PI was driven mostly by the answers I gave in the case.

He started the interview by asking why had the stock of HUL been stable at Rs. 200 per share for the last 10 years, whereas stock prices of other FMCG companies over the same time period had risen (the question came because I was from the FMCG background).

I started the analysis of the case by saying that I would benchmark HUL strategies against some of the other FMCG companies whose stock prices had risen. I took ITC as the benchmark, because I was working for ITC and evaluated HUL vs. ITC strategies on various levels. At this point the discussion become qualitative and H kept asking for my opinions, and I thought it became more of a PI than a case. When asked about my opinion on what was the primary reason for HUL stock prices not growing, I told him that I felt the HUL strategy of master-brands, i.e. eliminating various smaller brands into single umbrella brands was a wrong strategy for the Indian market. I told H that in the Indian market, there are various types of consumers with varying needs, and to have one brand catering to all segments may not be a good idea.

At this point, H asked me about my opinion on the ITC FMCG strategy. I gave some plus points, but H asked me what I thought ITC was not doing right. I told him that I felt that the names of the products Vivel, Fiama etc. were too foreign and unfamiliar, and maybe ITC was going wrong here. H told me that Lux and Lifebuoy, the largest selling soap brands also had foreign names. I told H that Lux and Lifebuoy have been around for such a long time that the names may not appear foreign to the Indian consumer anymore. I also added that I did not like the idea that ITC ended all its product names with WILLS, e.g. Fiama Di Wills, and there were many consumers who still attach the name WILLS with cigarettes and there are many people who would not buy the product just because of that.

H asked me how the reaction at my home was when I decided to join ITC, a company which apparently sells cancer. I gave him the standard ITC answer, which is ingrained into your head the moment you join ITC. H said he completely agreed with whatever I said. He then asked me about my long term goal. I told him that fortunately or unfortunately, I know that I don’t know what I want to do in the long term. However I had some tentative plan and I told him about Indian Hockey and my plan to set up an NGO. We had a small discussion on why I had these goals and I backed it up well, linking both back to previous experiences.

He then asked me if I had some questions, and I asked him what kept him going in the consulting career for so long. Again, there was a small discussion, but this time he was the one doing most of the talking.

He then gave me another case.

Case Question

H told me that there was new phenomenon that was emerging in the US. In the US, there are certain people who spot basketball and baseball players very early in age and pay them a lump sum amount when they are very young in return of a certain percentage of their lifetime earnings. H told me that our client wants to do the same for budding cricketers in India, and our job was to help him figure out what the lump sum amount should be how much percentage of lifetime earnings they should demand.

Case Type

Valuation Type Case (vaguely related to valuation actually)

Narration of the Case

The case was a vague one and I tried to structure it in some way. Since there were two parts to the problem, I decided to handle the two parts separately.

First part was to determine the lump sum amount. For this I told H that we needed to forecast the potential earnings of the selected cricketer and discount it back to the current date to get the NPV. This problem in structured in the following way:

1. Judging the potential – this would determine the potential income greatly. E.g. A Sachin Tendulkar would earn much more than VVS Laxman. Hence, the first step would be to identify the true potential. I suggested that we can use a comparable approach or expert opinion for the same.

2. Forecasting the future earnings:

a. Earning from core activities – match fees, board contracts etc.

b. Earnings from non-core activities – endorsements, advertisements etc.

Once we have identified the potential, we can estimate how much the cricketer of his caliber can earn in future.

3. Selecting the Discount Rate – since this was a very risky investment, as the potential earnings were not sure, subject to injuries etc., I suggested we use a high discount rate, of the order of 30-40% for discounting the earnings.

4. How much of the NPV should we pay to the cricketer – here we could take a percentage of the NPV (i.e. percent of the NPV we would get) or use a high discount rate incorporating all risks and pay the entire NPV(percent of the NPV we would get) to the cricketer.

The second part was to determine what percentage of lifetime earnings we should demand. Here I said it was essential to optimize the percentage of the earnings, because if the percentage of total earnings that we would in future is very high then there would be no incentive for the cricketer to perform. He might indulge in drugs, drinking etc. and may not pay attention to practice. Hence it was essential keep enough incentive for the cricketer to perform as well. To this, H asked me to draw the graph of upfront payment versus the percentage of total earnings that we would get. I drew the following graph:

Basically through the graph I intended to say that the upfront payment would plateau after a certain point, beyond which we should not pay any extra for any additional percentage of total income.

H seemed happy with the analysis and ended the case.

What I think went right for you in the interview

I think I structured a seemingly vague case reasonably well, which paid off. Also, the point that a higher percentage of total income would mean no incentive for the cricketer to perform was highly appreciated by H.

What I think went wrong in the interview

I did not handle the question of ITC FMCG strategy as well as I should have, especially as I was working for ITC. I should have been better prepared for that kind of a question.

Tips for the future batch based in this interview

Be very well prepared about the industry you were working in, including their current strategy, what they are doing right and what they are doing wrong, what you would have done differently etc.

Outcome

Was made the Offer!

Company: Burger, Interview No. 1

Interviewer: R, Principal

Personal Interview Questions

This was a very unique interview. The case started with a PI, followed with 3 cases. The PI questions are as follows:

1. Tell me about yourself

2. Biggest accomplishment

Then he asked me about Hockey (since I used to play Hockey in college) and enquired what was wrong with Indian Hockey, especially in light of the recent fiasco. I asked if this was a case, and he said I can take it as a case or give my opinion about it. I gave him my opinion on the issue. He then told solve the problem of Indian Hockey as a case.

Case Question

What should be done to improve Indian Hockey?

Case Type

Indian Hockey Case / Estimation/ Revenue Stream Identification

Followed by market size estimation of Tata Nano

Narration of the Case

I made simple Input->Process->Output structure, saying that the root of the problem was poor performance by the National team in international competitions. From the structure, it was clear that the output was poor, hence there must a problem in the input or the process. So I listed the various inputs like player quality, selection criterion, coach quality, domestic tournaments, prevalence of hockey in schools etc. In the process I listed training programs, coaching programs, coach training programs, infrastructure, availability of funding etc. We had a long discussion and the outcome was that the major problem in India was lack of Astroturfs, because of which the performance of players was weak in international events.

Post this R asked me how much does it cost to build and Astroturf. I knew that and told him the answer. He asked me what can be done so that this expense on Astroturf can be made self sustainable. I made a structure of Core Assets and Non-Core assets and identified revenue streams for both. For core assets, which were the turf itself, we identified avenues like renting for practice, local tournaments, school competitions etc. Non-Core assets were the property and land we would own around the turf, which can used for advertisements, leasing for juice-shops, food stalls etc.

R then asked me estimate the no. of Astroturfs are required in India for Indian hockey to improve. I said we can benchmark the no. of Astroturfs/ Sq. Km against a country which was doing well in world hockey, say Germany. On this we had a long discussion that Astroturfs/ Sq. Km may not be feasible comparison criterion considering the size and population density differential of India and Germany. Then I suggested we use a criterion of minimum distance to Astroturf as a criterion and compare it with Pakistan, which had similar population density but was performing much better than India in Hockey. R was okay with the answer.

To my surprise, I was given one more case to solve after this (considering the last case with already lasted more than an hour). R asked me to estimate potential market for Tata Nano in India. I made a standard market sizing top-down estimate, starting from population, income segments, population in target income segment, percentage conversion, cannibalization from cars like Maruti 800 and Alto, Upgrades from bikes, cannibalization from autos and taxis.

What I think went right for you in the interview

On the whole I think this was a very long interview and I kept my composure throughout. Also, I knew facts about Indian Hockey, like costs of Astroturf etc. which helped a lot.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

Read up on things that are there on your resume, especially if there is some current hot news on the same.

Outcome

Made it to the next round

Company: Burger, Interview No. 2

Interviewer: GR, Partner

Personal Interview Questions

GR started the PI picking on a particular point on my Resume where I had mentioned that I became the youngest HOD at ITC. He asked me if that was by luck or by something that I did. I told him that obviously luck was involved to an extent that the position was vacant at that time, but since there were 40 others who could have been given the role and given the fact that I was chosen obviously means that I must have done something good.

He then asked me a few questions on my work experience:

1. Biggest achievement at work

2. Issues when handling a unionized workforce

3. Biggest learning

4. Why MBA – I told him that the more pertinent question would be why MBA at this time and gave him a very well prepared answer.

At this point he ended the PI and went into the case.

Case Question

GR asked me to price a Hovercraft Service between 2 points in Mumbai (forgot the 2 points, am not very familiar with Mumbai geography). Following if the information that he provided (all one way costs):

1. A train between the 2 locations takes 45 min. , and costs Rs. 45

2. Taxi takes between 90-100 min., costs Rs. 450

We have 1 Hovercraft, it takes 20 min., seating capacity is 100 and it provides A.C. comfort.

Case Type

Pricing Case

Narration of the Case

I asked if there was some information on the demand supply gap, which could help in determining how much we could charge for the service. GR told me that no such information was available. I told GR that we can price the service as per three methods:

1. Cost Plus Pricing

2. Value Based Pricing

3. Competition Based Pricing

GR told me that for Cost Plus Pricing, the costs of the service for a one way turned out to be Rs. 700 per person (including required returns). He asked me if that price was a good price to keep for the service.

I enquired about the demand again. He told me that the demand was equivalent to 10,000 people/day. I then asked GR how many trips was the Hovercraft capable of doing in an hour. He gave me some information on the same: it took 5 min. for loading people and another 5 min. for unloading people, in addition to the 20 min. travel time. That meant 2 trips/ hr. for the Hovercraft. I also assumed 20 hrs of operation during a day making a total of 40 trips in a day. Remaining 4 hrs could be used for maintenance. However, of these 40 trips, only half were one way, the other half were return trips. Hence, only 20 trips / day for the one way trip was possible. With 100 people seating capacity, this meant a total capacity of 2000 people per day.

I told GR that since the total demand was 10,000 people per day, we needed to plot the demand curve and see how many people have the willingness to pay more than Rs. 700. If this no. was more than 2000, we can go ahead with the price. GR seemed okay with the answer and ended the case.

He asked me if I had any questions. Since GR was leading the Industrial and Operations practice, I asked him a few questions on the same.

What I think went right for you in the interview

The case was pretty straightforward, and there wasn’t much scope of error. However, the PI I thought was pretty quizzical and GR seemed very skeptical about the answers I gave. The good thing was that I kept my cool and backed my answers pretty well.

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

If you get a skeptical interviewer, do not get perturbed. Be confident and truthful, and back your answers well. Be prepared for cross questioning and defending your answers. Preparation of this in your prep group helps a lot.

Outcome

Made it to the next round. However, did not attend any further interviews because of schedule clashes with my XYC interviews. Decided to attend the XYC interviews since XYC was my first preference.

Company: Pearl, Interview No. 1

Interviewer: V, Managing Director

Personal Interview Questions

This was a typical PI first interview followed by a case. V started by saying that I had an excellent academic record and he was really impressed with my resume (made me feel happy). He then asked me about my work experience at ITC, and specifically asked me about both good and bad things in ITC according to my opinion. I gave an honest answer, and he agreed with the most part. He then asked me about my most significant achievement which I very easily answered. He then moved to the case.

Case Question

V first gave me a background of the TV industry. He told me about channels and broadcasters and told me that the bulk revenue source in the industry was advertising revenues. He then told me about a legislation that mandated a maximum of 10 min./hr of advertisements. He then told me that suppose STAR TV was our client, and had a no. of channels. For one of the channels, STAR ONE, the advertising revenues had remained flat at Rs. 500 Cr., whereas the market has grown during the same time by 10-15% a year. Our job was to identify why the revenues had stayed flat.

Case Type

Flat Revenues in Media Industry

Narration of the Case

I made a very simple structure, saying that revenues were a function of price and volume, and hence I wanted to look at the following items during the analysis:

1. Utilization of the available ad time – V told me that the utilization of paying clientele was stable at 50-60%, however the industry average was around 80%. The remainder time was filled with own commercials.

2. Price of ad per sec – V told me that the realized price per sec of ad was going up for the industry, but for their channel it remained the same.

I delved further into the issue by asking why this was the case, i.e. why the realized price had remained constant. V said he needed me to help him on this. I tried to indentify the drivers of the Price of Ad per sec, and came up with the following factors:

1. TRPs of the programs

2. Targeting of ads as per customer segment

3. Perishability of the product – hence whether a dynamic rate structure was being used as in the case of airlines.

There was some discussion on each of the issues, and here V was doing most of the talking. He told me about his experiences in the Media and Advertisement industry. Then we had a very interesting discussion on how TV channels were circumventing the legislation of Max. 10 min. ads per hour by using tickets, inlets etc. I asked him if he expected legislation on this issue, and he told me yes he did. He then ended the case and asked me if I had any questions. I asked him some questions in his field of work.

What I think went right for you in the interview

The case was pretty easy and hence everything went right (partly because very recently I had done a very similar case, thanks to Rishi Dogra)

What I think went wrong in the interview

Nothing

Tips for the future batch based in this interview

Practice cases from various industries. You don’t know how much it helps if you are slightly familiar with the industry.

Outcome

Made it to the next round

Company: Pearl, Interview No. 2

Interviewer: G, Principal

Personal Interview Questions

The PI was extremely short, and was rather weird. This was the only interview where I was asked about my failures in life. Nevertheless, since this was a standard interview question I was prepared for this. I gave him my answer and G followed it up with my learnings out of those failures. Again I was prepared for this and gave him a very well prepared answer. He ended the PI and started the case.

Case Question

Estimate the no. of parking slots required for a 500 bed hospital

Case Type

Estimation Case

Narration of the Case

First I identified the various categories of vehicles for which parking would be required in the hospital and came up with four major categories:

1. Patients/ Relatives

2. Doctors

3. Support Staff

4. Sales People

Then I estimated the no. of spots required for each of the 4 categories separately.

Patients – divided them into two parts, admitted and outdoor

No. of Parking spots required (admitted patients) = No. of Beds * Avg. Occupancy Rate * % of people coming in own vehicles. Assumed some nos. for each, 500 * 90% *50% = 225

No. of Parking spots required (outdoor patients) = No. of Beds * No. of doctors per bed * Avg. no. of people a doctor sees in 1 hr * % of people coming in own vehicles. Assumed some nos. for each, 500 * (1/10) * 4 *50% = 100

Total no. of parking slots required for patients = 225 + 100 = 325